Your Trusted Partner in Family Law Matters

Welcome to Affordable Family Lawyers

Our dedicated team of experienced family lawyers is committed to providing top-notch services at affordable rates, ensuring that you and your loved ones receive the guidance and assistance you need during difficult times.

Trusted Family Lawyers

Are you facing a challenging family situation that requires legal expertise and support?

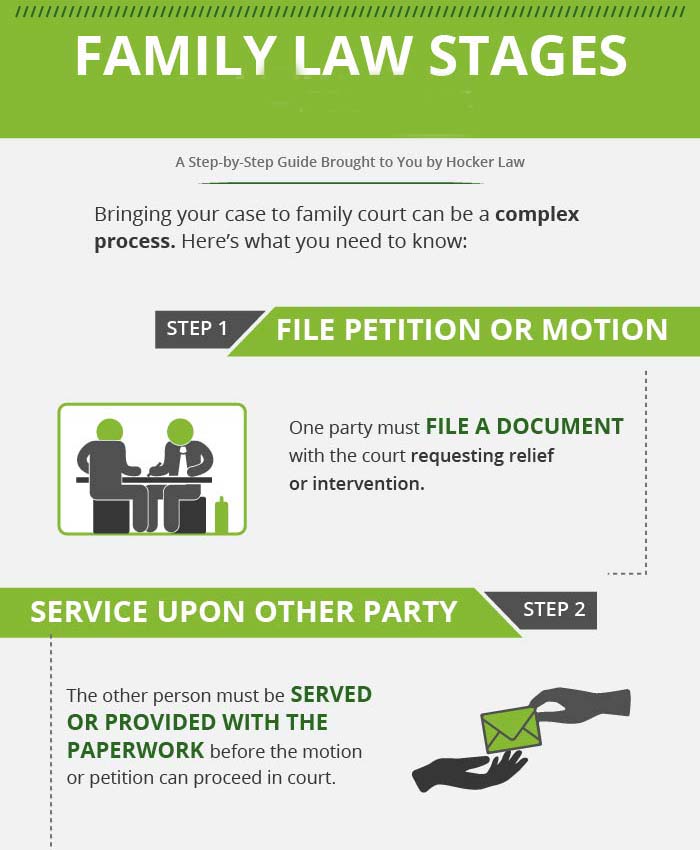

At Affordable Family Lawyers, we recognize that family law matters can be emotionally charged and complex. Our mission is to work together with our partner firm Chamberlains to alleviate your stress and concerns by offering professional, compassionate, and personalized legal services tailored to your unique situation. Whether you’re dealing with divorce, child custody disputes, adoption, or any other family law matter, our team is here to provide you with reliable advice and robust representation.

Request a Free Estimate

- Required Fields

Why Choose Us

We understand the importance of resolving family law matters efficiently and effectively. Our team works diligently to minimize delays and expedite the legal process, ensuring that your case is handled promptly while keeping you informed every step of the way.

Expertise and Experience

Our team of family lawyers boasts extensive experience in handling a wide range of family law cases.

Compassionate Guidance

We are dedicated to helping you make informed decisions while providing a safe space for you to express your concerns.

Affordable Rates

We believe that legal representation should be accessible to everyone. Our commitment to affordability means that you can receive legal services.

Comprehensive Services

Our team of family lawyers is equipped to handle a wide range of family law matters, including divorce and separation.

Personalized Approach

We understand that no two family law cases are alike. That's why our team takes the time to listen attentively to your concerns, goals, and priorities.

Client-Centered Approach

We strive to build strong, long-lasting relationships with our clients based on trust, respect, and open communication.

What our clients say

Latest Articles

- All Work

- /construction law

- /Family Law

- /Online wills

- /Property Law

- /Relationships

- /Uncategorized

Need A Free Consultation?

Contact Affordable Family Lawyers to schedule a consultation and discover how we can assist you in protecting your rights, securing your future, and achieving the best outcome for you and your family.